Did you know Progressive Insurance now covers a wide range of needs? They protect your home, motorcycle, and even your RV. My experience with them showed me how crucial it is to have insurance that fits your life.

Getting an online insurance quote is easy, making things less stressful. Progressive blends technology with personal service. This makes them stand out for your insurance needs.

Key Takeaways

- Progressive Insurance offers a wide variety of smart coverage options for car, home, motorcycle, and RV insurance.

- The user-friendly online insurance quote system saves time and provides clarity on policies.

- Customizable features and comprehensive policies set Progressive apart for all your insurance needs.

- Technology like mobile apps makes policy management and the claim process more convenient.

- The adoption of innovative tools and services by Progressive enhances overall customer experience.

Understanding Progressive Insurance Coverage Options

Looking into insurance can feel overwhelming. But, knowing what Progressive offers makes it easier. They have plans for cars, homes, and even RVs, tailored to fit your needs.

Car Insurance Policies Explained

Progressive car insurance is known for its wide range of coverage. It suits different vehicles and drivers. You get everything from basic liability to full coverage for accidents.

Home Insurance for Homeowners and Renters

Progressive has strong policies for homes and renters. Homeowners get help with big repairs and replacements. Renters can protect their stuff from unexpected damage.

Specialized Coverage: Motorcycle and RV Insurance

Motorcycle and RV fans will love Progressive’s special plans. These policies are made for the unique risks of road trips. They cover damage and liability, so you can enjoy your adventures worry-free.

Knowing about these options helps you choose the best protection. This way, you’re always covered, no matter what life brings.

Maximizing Benefits with Progressive Insurance

Progressive Insurance stands out by focusing on customer benefits. They offer tailored insurance plans and exclusive discounts. Each part of their service is made to improve user satisfaction and security.

Bundle Insurance Packages for Additional Savings

Bundle insurance packages from Progressive can save you a lot. Combining auto and home insurance, for example, simplifies your coverage and saves money. This approach not only makes managing your insurance easier but also lowers your costs.

Loyalty Rewards and Customized Discounts

Progressive Insurance values customer loyalty. Their loyalty rewards program offers bigger savings and perks to long-term customers. They also provide customized discounts, making insurance more personal and valuable.

Progressive’s personalized approach makes you more than just a policy number. They consider your unique situation to offer better benefits. Options like safe driver discounts and continuous insurance rewards help you save.

| Feature | Benefit |

|---|---|

| Comprehensive bundle options | Reduced premiums and simplified coverage |

| Loyalty rewards program | Deductions and perks increase with loyalty |

| Customized discounts | Discounts adjusted to customer’s specific needs |

In summary, Progressive Insurance offers clear benefits through bundle packages, loyalty rewards, and customized discounts. Their focus on personalized service ensures you get the most out of your insurance. This approach brings you peace of mind and significant financial savings.

Comparing Insurance Rates: Why Choose Progressive

When you’re looking to compare insurance rates, it’s key to look closely at the details. This is why Progressive insurance benefits shine in a crowded market. They offer flexible and clear pricing, especially when insurance costs are going up.

Recent data shows big jumps in insurance prices, thanks to things like natural disasters. For example, Hurricane Ian in 2022 caused $112.9 billion in damage. This highlights the importance of strong insurance. Here’s how Progressive stacks up in this changing market:

| Insurance Type | Progressive Benefits | Market Average Premium Increase |

|---|---|---|

| Home Insurance | Customizable coverages, flood insurance add-on | 34% (2017-2023) |

| Auto Insurance | Snapshot program, potential savings for safe drivers | Varies by state and driver history |

| Property Insurance | Large network of repair services, quick claims process | 25% increase post-claim |

The flexibility in Progressive insurance benefits helps protect against these market shifts. Progressive doesn’t just focus on low rates. They also offer discounts and rewards for loyal customers, making insurance more affordable and valuable.

To really compare insurance rates, you need to understand the big picture and what you need personally. Progressive’s personalized approach ensures you get the right coverage. They offer financial stability and support you can count on.

Online Insurance Quote: Streamline Your Insurance Process

Choosing the right insurance can be overwhelming. Progressive Insurance makes it easier with its online quote tool. It’s easy to use and convenient.

Easy Online Application

The Progressive easy application is designed to simplify getting insurance. Forget about filling out endless forms. Just enter your info once and get quotes that fit your needs.

This system uses your data smartly. It cuts down on repetitive tasks and ensures your quotes are accurate. You can review and change them as needed.

Tips for Getting Accurate Quotes Quickly

Getting accurate quotes starts with accurate data. Make sure your application information is correct and complete. Here are some tips:

- Documentation: Have all necessary documents ready, like driver’s license numbers and home details, to avoid mistakes.

- Details: Be truthful and detailed about your driving history or home condition.

- Comparison: Use the chance to compare different plans. Progressive’s interface makes it easy to modify and compare policy details.

Technology can make getting insurance quotes easy and enjoyable. Progressive leads the way in using tech for customer service. With just a click, you can explore your insurance options more easily than ever.

Progressive Insurance and Technology: A Smart Match

Progressive Insurance uses the latest technology to make things better for users and to work more efficiently. They use technology in insurance to offer services through their Progressive mobile app and usage-based insurance. This makes them leaders in the industry.

Mobile App Features and Benefits

The Progressive mobile app shows how technology can make insurance easier. It lets users check their policy, file claims, and talk to customer service anytime. This app makes managing insurance simple and keeps services accessible, so help is always close by.

Progressive’s Usage-Based Insurance Options

Progressive is a leader in usage-based insurance. They use telematics to check how you drive and offer rates based on your driving habits. This encourages safe driving and can help you save money on your insurance.

By using technology in insurance, Progressive keeps improving its services. They focus on making customers happy and safe. With their Progressive mobile app and usage-based insurance, they aim to change the insurance world.

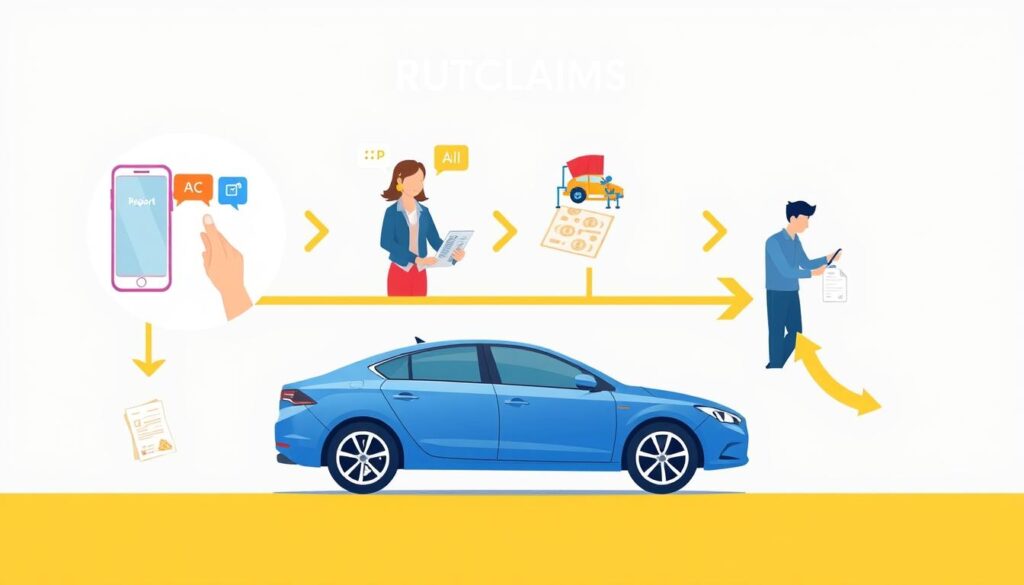

Navigating Auto Claims with Progressive Insurance

Understanding the car insurance claim process with Progressive Insurance can seem tough. But it’s designed to be easy and quick. When something unexpected happens, knowing how to handle Progressive auto claims can make things less stressful.

The Claims Process Simplified

The first step is to report the accident quickly. This starts your claim and gets a claims representative to help you. They make sure you have all the right documents and evidence, making the process faster.

Getting the Most from Your Car Insurance Claim

To maximize insurance claim benefits, document the incident well. Take photos, record damage, and get witness statements and police reports if you can. With good documentation, Progressive can assess your claim better and give you the right compensation.

Maximizing your claim isn’t just about money. It’s also about knowing your policy’s coverage, like rental cars and medical costs. This way, you use all the benefits Progressive offers during the claim process.

Here’s a quick look at what a typical Progressive auto claims process includes. It helps you prepare and know what to expect:

| Action Item | Description | Expected Time Frame |

|---|---|---|

| Report the Incident | Initial notification to Progressive about the accident, leading to the assignment of your claims representative. | Within 24 hours of incident |

| Documentation Collection | Gathering of necessary documents such as photos, witness statements, and police reports. | 1-3 days post-incident |

| Claim Assessment | Detailed evaluation of the damage and the claim by an insurance adjuster, considering all collected documents. | 1-2 weeks |

| Claim Resolution | Final settlements and discussions about repairs, compensation, and other claim benefits. | 2-4 weeks |

Knowing the Progressive auto claims timeline and what you need to do can help. It makes the process smoother and faster, leading to a better experience and quicker recovery.

Progressive Insurance: Beyond the Policy

Progressive Insurance is known for more than just their policies. They offer a wide range of services that go beyond what most insurance companies do. They focus on making a real difference in their customers’ lives.

Progressive is dedicated to teaching their clients about road safety and how to get the most out of their policies. This helps make their customers safer and more knowledgeable about insurance.

| Educational Focus Area | Benefits to Policyholders |

|---|---|

| Road Safety Programs | Reduces risk of accidents through better driving practices |

| Policy Optimization Workshops | Helps customers understand how to maximize their policy benefits |

| Claims Process Information | Guides clients on efficient and effective claims submission |

Progressive’s goal is to educate and empower their clients. It’s not just about selling policies. It’s about building a partnership that benefits both sides.

Progressive Insurance also gets involved in community projects. This shows they care about their clients and the community too. They sponsor events and join road safety campaigns.

Progressive Insurance offers more than just services. They provide excellent customer service, educational resources, and community involvement. Choosing Progressive means entering a relationship built on trust and mutual benefit.

Customer Stories and Testimonials on Progressive Insurance

Seeing how an insurance provider makes a difference is best through progressive customer testimonials and insurance client experiences. Our clients often talk about how our policies change their lives, especially during tough times.

Real Customer Experiences

Our customers’ stories show the security and service of Progressive Insurance. One client told us how our team handled a complicated claim after a small accident. They made sure everything was okay and fixed it fast.

Another family shared their story in a video testimonial. They were happy with how easy it was to deal with us after their house caught on fire. This shows the real value we offer every day.

How Progressive Stands Out: Client Perspectives

What makes Progressive special is our wide range of coverage and deep customer care. Insurance client experiences often talk about our unique policies that really fit what people need. A client said our flexible payments and early policy checks made them feel appreciated.

This caring and tailored approach is why many people choose and keep choosing Progressive.

These stories show our commitment to great coverage and service. They highlight the Progressive difference, thanks to our clients’ real experiences.

Conclusion

Reflecting on Progressive Insurance, I see a perfect blend of customer focus, new ideas, and solid coverage. Their use of technology and flexible policies meets my need for safety and smart spending. They offer online quotes and mobile app support, showing their commitment to making things easy and useful.

My research shows Progressive is a top pick for those who want good coverage without breaking the bank. They offer a wide range of insurance, from cars to homes, and even discounts for bundling. This flexibility shows they really get what customers need.

Looking at bigger issues like the economy, health care, and green energy, I see how insurance fits into these topics. This makes me trust Progressive more, knowing they’re not just about insurance. They’re also working towards a better future with investments in clean energy and tackling big social issues.